Donald Trump has labeled China's new AI model, DeepSeek, a "wake-up call" for the US tech sector following a significant market value drop for Nvidia, nearing $600 billion.

DeepSeek's emergence triggered a sharp decline in AI-focused company stocks. Nvidia, a major GPU supplier for AI models, suffered the most, experiencing a 16.86% share plunge—a record on Wall Street. Microsoft, Meta Platforms, Alphabet (Google's parent company), and Dell Technologies also saw declines ranging from 2.1% to 8.7%.

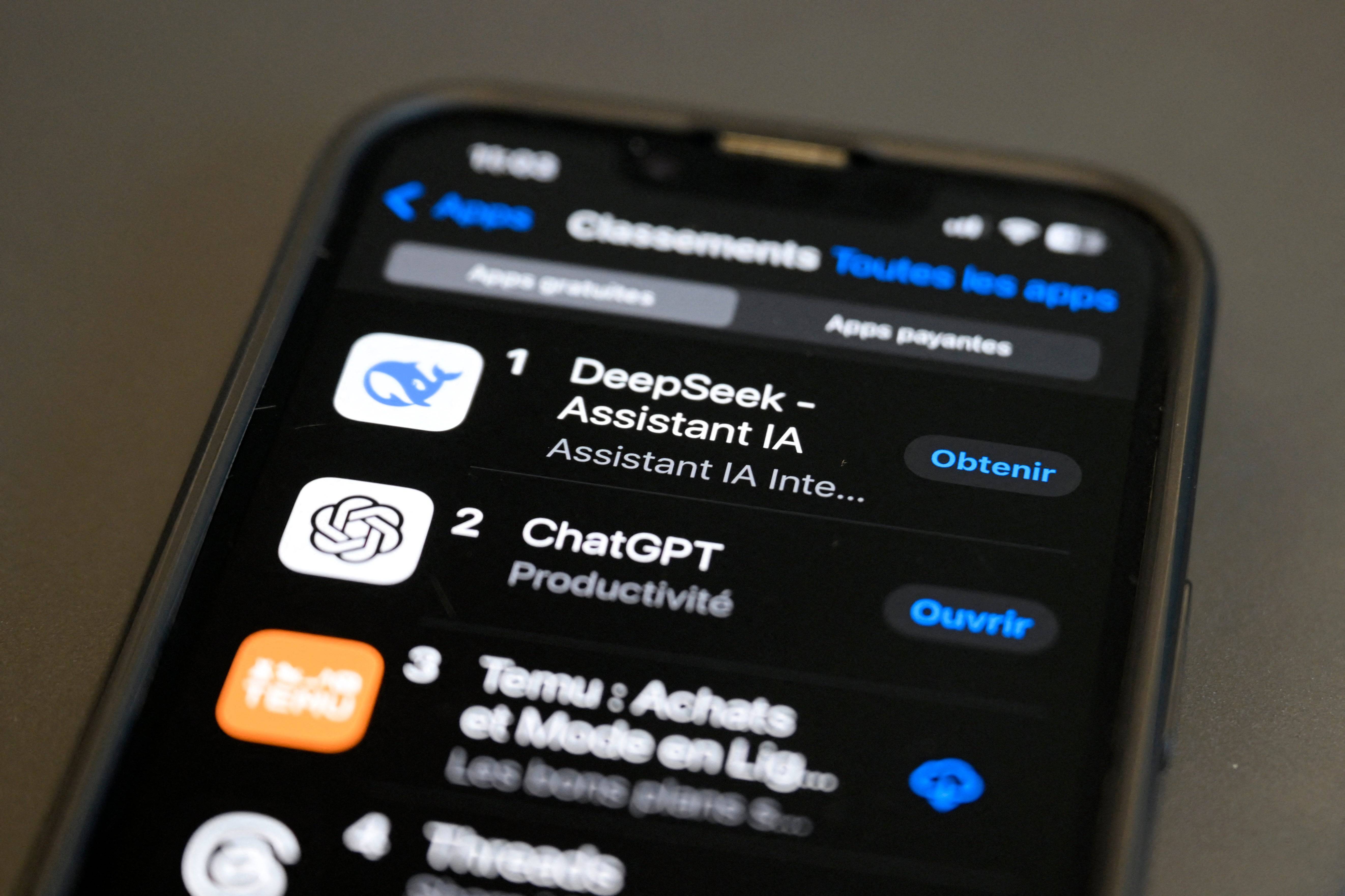

Although this claim is contested, DeepSeek has raised concerns about the massive AI investments of American tech companies, unsettling investors. Its popularity surged, reaching the top of US free app download charts amid growing discussions about its efficacy.

Sheldon Fernandez, co-founder of DarwinAI, commented to CBC News, stating that DeepSeek's performance rivals leading Silicon Valley models, potentially exceeding them in some areas, but using significantly fewer resources. He highlighted the disruption to business models reliant on high valuations, noting the availability of comparable features for free compared to paid subscriptions for Western AI models.

Trump, however, offered a more optimistic perspective, suggesting DeepSeek could benefit the US by reducing development costs while potentially achieving similar results. He emphasized the US's continued AI dominance.

Despite DeepSeek's impact, Nvidia remains a $2.90 trillion company. The company's upcoming RTX 5090 and RTX 5080 GPU releases are highly anticipated, with consumers already lining up for purchase.

Latest Downloads

Latest Downloads

Downlaod

Downlaod

Top News

Top News